1976-85 • A Second Home Out East

The bold and visionary moves undertaken by the College in the prior decade continued to generate dividends for St. Joseph’s. Additionally, changes in New York state financial aid and direct state aid made independent colleges an affordable option for more students, leading to strong enrollment growth at SJC’s campuses in Brooklyn and Brentwood.

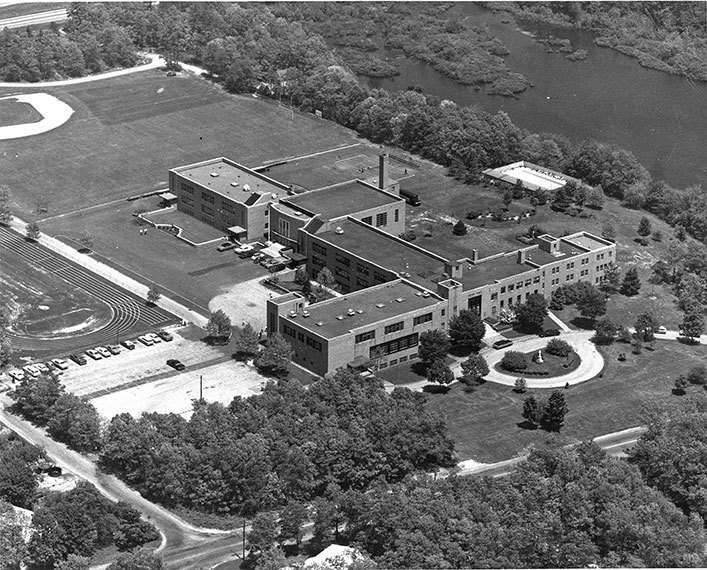

When the former Seton Hall High School property in Patchogue became available in the spring of 1979, the College seized the opportunity to move what was an extension program in Brentwood and convert it into a full-fledged campus in Patchogue. Full-time enrollment soon surged past 2,000 students across the two campuses. The Long Island campus closed out the decade by making its first significant modification, renovating the former Seton Hall caretaker’s cottage into the Clare Rose Playhouse in 1985.

After buying the former Seton Hall High School property in Patchogue, SJC opened its Long Island campus there in 1979. The campus came to be called SJC Long Island.

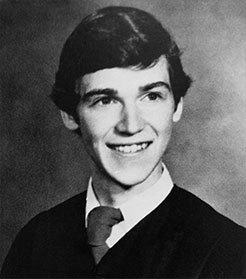

Thomas Kerrigan ’82

From chapel player to legal eagle

There’s something that set Thomas Kerrigan apart from his fellow thespians in SJC Brooklyn’s Chapel Players Dramatic Society: He loved tax law … and apparently still does.

Long before becoming a tax attorney for the U.S. Department of the Treasury, Mr. Kerrigan spent his undergraduate college years expanding his interest in theatrical arts while earning a bachelor’s in social sciences with a concentration in economics from SJC Brooklyn.

“I owe much of my professional success to SJC,” said the 1982 graduate, who was awarded SJC’s Presidential Scholarship.

“It provided a great environment for learning and the B.A. that I earned helped me secure my first professional job and the opportunity to further my education,”added Mr. Kerrigan, who continues to support SJC and in recent years has participated in the SJCMentor program.

“It provided a great environment for learning and the B.A. that I earned helped me secure my first professional job and the opportunity to further my education,”added Mr. Kerrigan, who continues to support SJC and in recent years has participated in the SJCMentor program.

After graduating from SJC, he worked as an import specialist at Bernard Lang & Co. – a customs house broker in New York City – preparing U.S. Customs import entry documentation and calculation of applicable duty rates.

Meanwhile, he returned to school, graduating from Brooklyn Law School before becoming an economist with the U.S. Department of Labor in the Bureau of Labor Statistics. In that role, he collected, processed and analyzed statistical data for multiple industry programs. In 1995, Mr. Kerrigan became a tax attorney with the U.S. Department of the Treasury.

“Now, I litigate cases before the United States Tax Court and work on significant tax administration issues,” Mr. Kerrigan said. “The greatest challenge for the tax professionals in my organization is dealing with the increased complexity of the Internal Revenue Code and tax compliance issues related to multinational corporations.”

– VALERIE ESPOSITO